Are you required to submit a cancelled cheque for a financial transaction or verification process but unsure of how to do so? Don’t worry; we’ve got you covered. In this comprehensive guide, we will walk you through what a cancelled cheque is, why it is needed, and the step-by-step process of writing a cancelled cheque. Additionally, we will address common mistakes to avoid and provide tips for ensuring a seamless process. Let’s dive in!

What is a Cancelled Cheque?

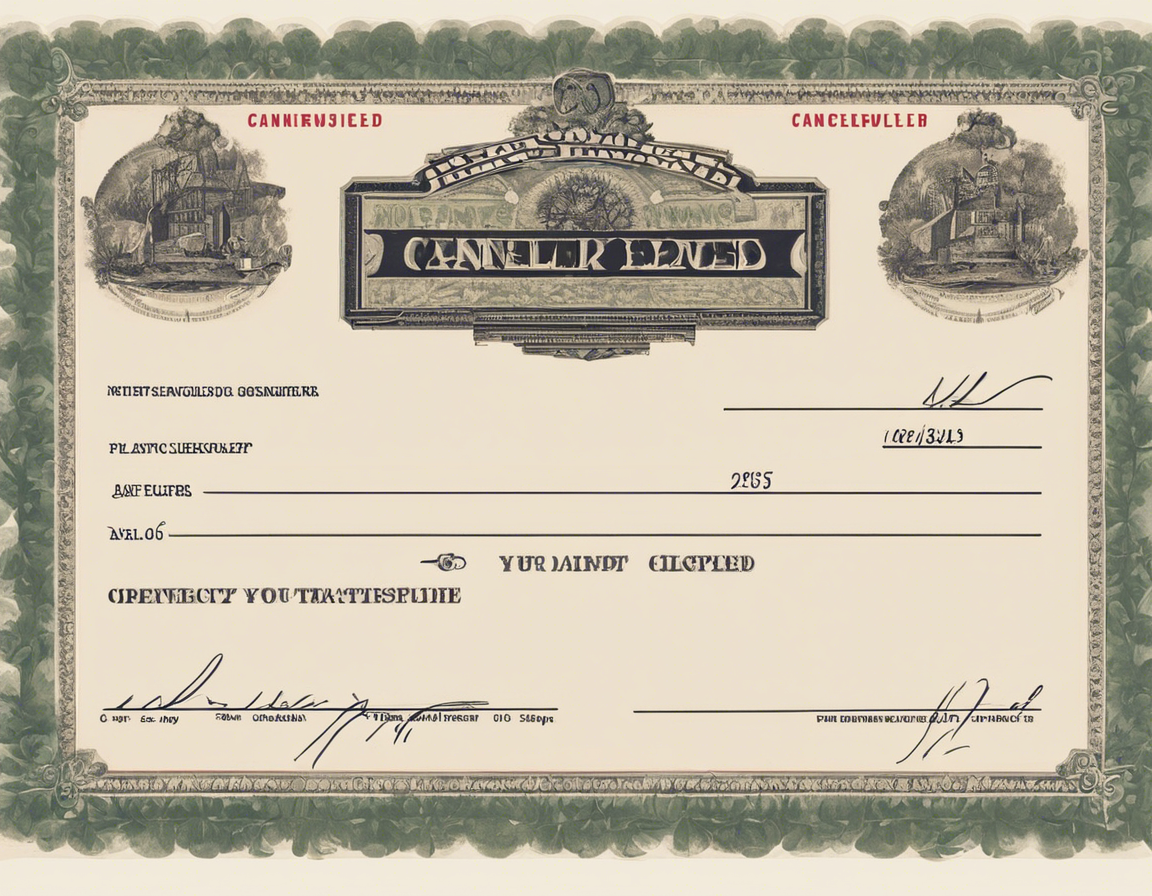

A cancelled cheque is a cheque on which the word “CANCELLED” is marked across it in a prominent manner. The purpose of a cancelled cheque is to provide a voided instrument that cannot be used for financial transactions but contains essential information such as the account holder’s name, account number, and IFSC code. It is commonly used for verifying bank account details, setting up electronic payments like ECS (Electronic Clearing Service) mandates, and for various other administrative purposes.

Why is a Cancelled Cheque Needed?

- Account Verification: When you need to provide proof of your bank account details, a cancelled cheque serves as a convenient and secure way to do so.

- Automated Payments: For setting up automatic payments or deposits, organizations often require a cancelled cheque to ensure accurate transfer of funds.

- Income Tax Purposes: Cancelled cheques are also used in income tax filings and for receiving tax refunds directly into your bank account.

- Loan Processing: Many loan applications ask for a cancelled cheque to verify the borrower’s bank account information.

How to Write a Cancelled Cheque: Step-by-Step Guide

Step 1: Gather the Materials

- A blank cheque from your chequebook

- A pen or marker (preferably black or blue)

Step 2: Fill in the Date

- Write down the current date on the cheque. This is essential for ensuring the cheque is not used fraudulently.

Step 3: Write “CANCELLED” across the Cheque

- In bold and clear letters, write the word “CANCELLED” across the cheque. Make sure it covers the cheque from end to end to prevent anyone from using it.

Step 4: Mark the Cheque as Void

- To further prevent any misuse, mark the cheque as void by writing “VOID” in a way that it cannot be easily erased.

Step 5: Fill in Account Holder Details

- Underneath the cancellation marks, write your name as it appears in your bank records. This ensures the cheque is associated with the correct account.

Step 6: Add Account Number and IFSC Code

- Write down your bank account number and the IFSC code of your bank branch. This information is crucial for identifying the correct bank account.

Step 7: Check for Accuracy

- Double-check all the details you have filled in to ensure accuracy. Mistakes in account numbers or IFSC codes can cause delays in processing.

Tips for Writing a Cancelled Cheque:

- Use a ballpoint pen or a permanent marker to prevent smudging or fading.

- Avoid using pencils or light-colored pens that can be easily altered.

- Ensure the cheque is not folded or crumpled, as this may affect its validity.

- Store the cancelled cheque in a safe place to prevent unauthorized use.

Common Mistakes to Avoid:

- Incomplete Details: Ensure all required information such as name, account number, and IFSC code is clearly mentioned.

- Illegible Writing: Write legibly to avoid any confusion or misinterpretation of the details.

- Using an Actual Working Cheque: Never use a cheque that is still active, as it can lead to unauthorized transactions.

Frequently Asked Questions about Cancelled Cheques:

1. Can I use a photocopy of a cancelled cheque?

No, it is recommended to use the original cancelled cheque to ensure authenticity and prevent any discrepancies.

2. Is a cancelled cheque the same as a blank cheque?

No, a cancelled cheque is different from a blank cheque. A blank cheque does not have any cancellation marks and can be used for financial transactions.

3. Do I need to sign a cancelled cheque?

No, you do not need to sign a cancelled cheque. The cancellation marks and account details are sufficient for verification purposes.

4. How long is a cancelled cheque valid for?

While there is no expiration date for a cancelled cheque, it is advisable to provide a recent one to ensure the accuracy of bank account details.

5. Can I cancel a cancelled cheque?

Once a cheque is cancelled, it cannot be used for financial transactions. However, if you suspect misuse, you should inform your bank immediately.

In conclusion, knowing how to write a cancelled cheque is an essential skill for managing various financial transactions and verifications. By following the simple steps outlined in this guide and being mindful of common mistakes to avoid, you can navigate the process with ease and confidence. Remember to always prioritize the security of your bank account information and double-check the details before submitting the cancelled cheque for any official purposes.